2024.10.22

- SLOW

- 2024년 10월 22일

- 4분 분량

Crude tanker shift could propel LR2 rates to $60,000 per day this winter

Clean tanker rates are expected to rise as crude tankers, which had shifted to carrying refined products for higher earnings, return to crude oil transport during the winter. These "crude cannibals" currently make up 3% of the clean tanker capacity but account for 6% of tonne-miles due to operating on long-haul routes. Analysts predict that LR2 tanker rates could more than double to $60,000 per day as crude tankers exit the refined products market. Seasonal export activity is also expected to boost product tanker rates, with LR2s already experiencing an increase in rates.

[SLOW] LR2 Market Monitor _ Global : Daily LR2 ton miles by loading zone

------------------------------------------------------------------------------------------------

Navios Maritime secures $110 million Saudi Aramco charter for four tankers

Navios Maritime Partners, led by Angeliki Frangou, has secured a three-year charter extension with Saudi Aramco for four MR2 tankers, generating approximately $110 million in contracted revenue. The vessels—Nave Capella, Nave Orion, Nave Titan (all built 2013), and Nave Pyxis (built 2014)—are chartered at a rate of $25,000 per day. These ships are already employed by Saudi Aramco, operating between the Red Sea and Middle East Gulf. Navios has a strong partnership with Aramco and other major firms. Additionally, Navios recently secured other significant charters, including a VLCC fixed to Trafigura for up to 28 months at $45,000 per day. The company continues to expand, managing a fleet of about 150 vessels and securing $561 million in new charters in the second quarter of 2024.

------------------------------------------------------------------------------------------------

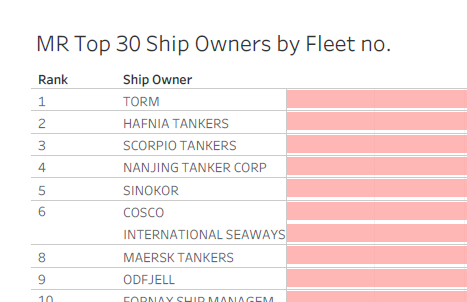

[SLOW] Tanker Fleet Study _ MR Top 30 shipowners by fleet no.

Hafnia expands MR tanker pool with new partnerships in Vietnam

Singapore-based Hafnia has strengthened its MR tanker pool by partnering with two Vietnamese companies, PVTrans Oilfield Services and Pacific Petroleum. PVTrans adds the 47,400-dwt PVT Valencia (built 2008) to the pool, starting operations in Egypt, while Pacific Petroleum contributes the 50,700-dwt Pacific Pride (built 2009), starting in Rotterdam. Hafnia now manages 69 MR tankers in its pool and controls a total of 199 tankers, including 115 owned vessels. This move enhances Hafnia’s regional presence and collaboration with key industry players. PVTrans, owned by state oil company Petrovietnam, operates 22 tankers, and Pacific Petroleum is a new entrant to vessel databases.

------------------------------------------------------------------------------------------------

[SLOW] https://slowspace.io/ Oil Pipeline Trans Mountain Pipeline

Canadian Natural Resources expands Trans Mountain Pipeline capacity after PetroChina exit

Canadian Natural Resources (CNR) is increasing its shipping capacity on the Trans Mountain pipeline by taking over space previously held by PetroChina. This move follows CNR’s $6.5 billion acquisition of Chevron's assets in the Athabasca oil sands and Duvernay shale. The 20-year contract boosts CNR's pipeline space by 75%, enabling it to ship 164,000 barrels per day (bpd). The expanded Trans Mountain pipeline has a total capacity of 890,000 bpd, transporting crude from Alberta to Vancouver. PetroChina has confirmed it will no longer be a committed shipper on the pipeline.

------------------------------------------------------------------------------------------------

[SLOW] https://slowspace.io/ Gas Pipeline Power of Siberia pipeline

China surpasses Europe as Russia’s largest market for pipeline gas

China is set to overtake Europe as Russia's top market for pipeline gas in 2024, with Gazprom exporting 23.7 billion cubic meters to China in the first nine months of the year—a 40% increase from last year. This surpasses the 22.5 billion cubic meters sent to Europe during the same period, following reduced flows due to Russia's invasion of Ukraine. Gazprom has ramped up supplies to China through the Power of Siberia pipeline, which will reach its maximum capacity earlier than planned. Meanwhile, European nations continue to seek alternatives as Gazprom’s transit deal with Ukraine nears its expiration in December 2024, risking further disruptions to European supplies.

------------------------------------------------------------------------------------------------

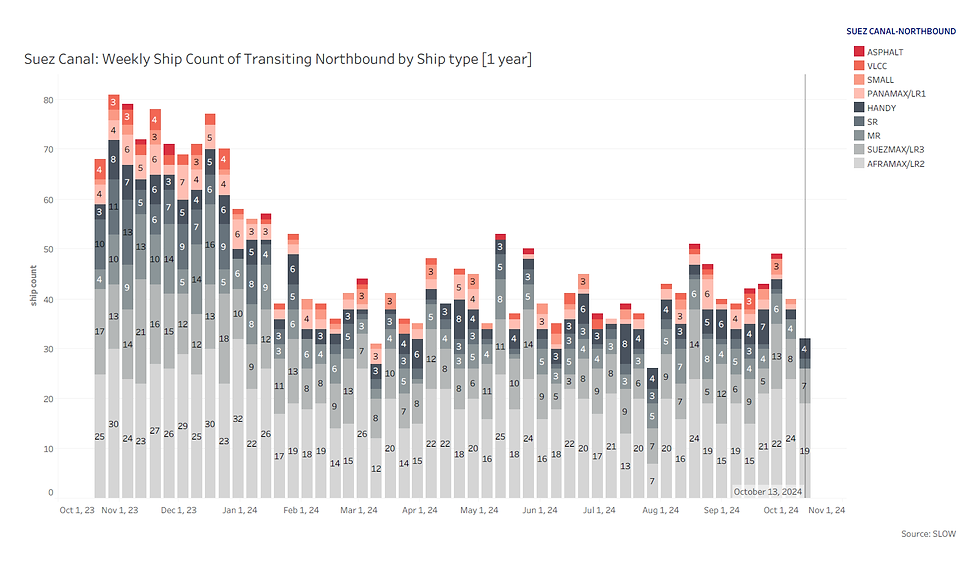

[SLOW] Tanker Canal Traffic Monitor _ Suez Canal : Weekly ship count of northbound by ship type

Suez Canal traffic drops, Panama Canal recovers amid geopolitical and environmental changes

Clarksons research highlights a significant shift in global shipping routes, with the Suez Canal experiencing a sharp 70% drop in gross tonnage transits compared to 2023 due to Houthi attacks in the Red Sea. Container, car carrier, cruise, and LNG ship crossings through the Suez have fallen by over 90%, while bulker and tanker traffic is down 40–50%. Meanwhile, Panama Canal transits have surged by 35% after easing water level-related restrictions. Container ship transits through Panama have been particularly strong since May, partly driven by rerouting from the Red Sea. Clarksons predicts this trend of rerouting away from the Red Sea will persist into 2025 due to ongoing geopolitical instability.

------------------------------------------------------------------------------------------------

Price Cap Coalition urges vigilance in tanker sales

The Price Cap Coalition, which includes G7 nations, the EU, Australia, and New Zealand, has issued new guidelines urging vigilance in tanker sales to prevent sanctions evasion and environmental risks. The recommendations target the growing "shadow fleet" of older tankers used to transport Russian crude, encouraging enhanced due diligence by shipowners and brokers, especially when selling to unfamiliar buyers. The coalition emphasizes verifying the ultimate beneficial ownership of vessels and monitoring potential illicit activities. The new guidance also calls for stricter compliance with maritime and environmental standards, and heightened caution against interactions with sanctioned entities.

[SLOW] OFAC Sanction Tanker List _ OFAC-listed tanker count by ship type

------------------------------------------------------------------------------------------------

Shell reports 30-40 ton oil and water slop spill in Singapore waters, cleanup underway

Shell has reported a spill of 30-40 metric tons of slop—a mixture of oil and water—into the waters off Singapore following a land-based pipeline leak. The spill occurred near Bukom Island early Sunday morning. Shell is working with authorities to manage the cleanup, deploying containment booms, anti-pollution crafts, and dispersants. This follows a larger spill earlier in the year that impacted Singapore's southern coast. Precautionary measures have been taken to prevent further spread, and the public has been advised to avoid swimming at affected beaches. No additional oil sightings were reported as of Sunday afternoon.

Comments