2024.10.07

- SLOW

- 2024년 10월 7일

- 5분 분량

Iranian oil tankers evacuate key anchorage as Middle East tensions escalate

Several oil tankers near Iran's largest crude-loading facility, Kharg Island, have fled the area following Iran's missile strikes on Israel earlier this week. Satellite data shows tankers that were previously anchored in the region have dispersed across the Persian Gulf, though this movement has not affected oil loadings. The evacuation is seen as a precautionary response as the world anticipates potential retaliatory actions against Iran, with U.S. President Joe Biden acknowledging discussions with Israel about targeting Iranian oil assets. This marks the first significant tanker exodus since 2018, though Iran continues to export substantial oil volumes despite ongoing sanctions.

[SLOW] https://slowspace.io/ Kharg Island Port _ Anchorage

------------------------------------------------------------------------------------------------

Oil prices surge, recording biggest weekly gains in over a year

Oil prices rose on Friday, marking the largest weekly gains in over a year due to fears of a wider conflict in the Middle East. Brent crude settled at $78.05 per barrel, while U.S. West Texas Intermediate closed at $74.38. Concerns escalated after Israel vowed to retaliate against Iran for a missile attack, sparking fears of disruptions to Iranian oil supplies. However, prices pulled back after U.S. President Joe Biden urged Israel to explore alternatives to striking Iranian oil facilities. Despite this, Brent crude rose over 8% for the week, while WTI gained 9.1%. Low global oil inventories and ongoing geopolitical tensions suggest that prices could remain high, with analysts forecasting potential price jumps if Iranian oil infrastructure is targeted.

[SLOW] Oil Market Oil Price Benchmark

------------------------------------------------------------------------------------------------

Saudi Arabia raises oil prices for Asia as Middle East tensions fuel market volatility

Saudi Arabia has raised the price of its Arab Light crude by 90 cents for buyers in Asia, bringing the premium to $2.20 per barrel over the regional benchmark, amid growing volatility in the oil market. The price hike comes as tensions in the Middle East escalate, with oil prices spiking over 8% this week following missile strikes by Iran on Israel. Despite market concerns about soft demand, particularly in China, OPEC+ members, including Saudi Arabia and Russia, have delayed planned output increases until December. This pause may result in Saudi Arabia exporting less than 6 million barrels per day for the fourth consecutive month.

[SLOW] Oil Market _ MEG Oil Price

------------------------------------------------------------------------------------------------

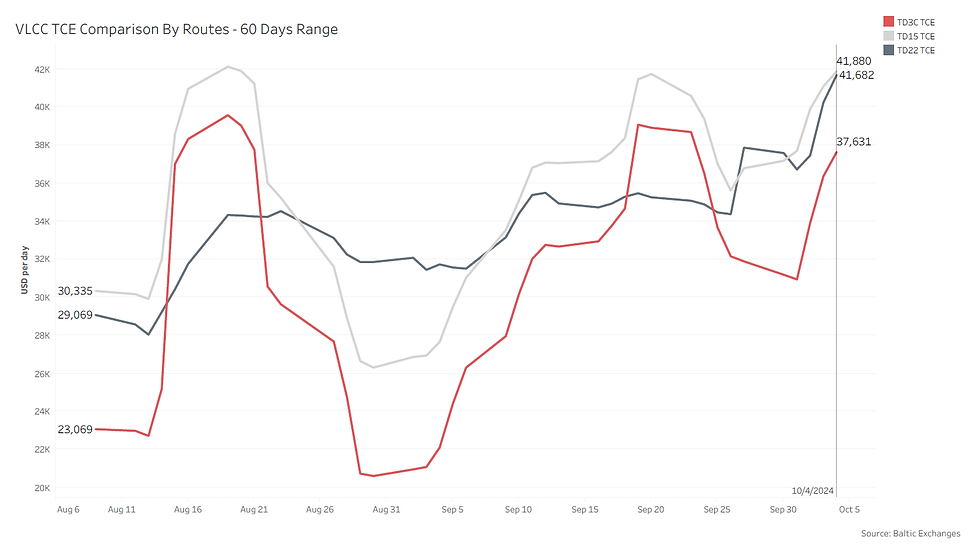

[SLOW] Daily VLCC Market _ VLCC TCE comparison by routes

OPEC's market share strategy could trigger VLCC rate surge to $100,000 per day

OPEC’s potential shift in strategy from price protection to market share could spark a surge in VLCC rates, with projections suggesting they could reach $100,000 per day. According to analyst Omar Nokta of Jefferies, OPEC+ may boost oil supply by 3.3 million barrels per day in 2024, driving VLCC utilization to 90%. This shift would create tightness in the tanker market, potentially leading to high profits for VLCC owners for up to two years. Similar shifts in 2014 caused tanker rates to spike, though a glut of newbuildings then tempered the frenzy. With a subdued orderbook this time, the rate hike could persist longer. VLCC rates have already risen, with Middle East to China routes currently earning $39,754 per day, and other routes exceeding $44,000 per day.

------------------------------------------------------------------------------------------------

[SLOW] https://slowspace.io/ Trade Flow Spain seaborn crude imports from Venezuela by ship type

Spain's crude oil imports from Venezuela reach 15-year high

Spain's crude oil imports from Venezuela have surged to a 15-year high, reaching over 2 million metric tons by August 2024, a level not seen since 2009. In August alone, Spain imported 303,000 metric tons of Venezuelan crude. The increase in Venezuelan exports to Europe and North America has been supported by U.S. licenses that allow Venezuela's state oil company, PDVSA, to export despite sanctions. Spain's largest oil company, Repsol, has notably boosted its imports from Venezuela as part of a debt repayment agreement.

------------------------------------------------------------------------------------------------

[SLOW] https://slowspace.io/ _ Northern Sea Route

2024 set to break records for Northern Sea Route transits amid rising cargo volume

The Northern Sea Route (NSR) is on track for record transit numbers in 2024, primarily driven by shipments between Russia and China. According to the Centre for High North Logistics (CHNL), approximately 2.4 million tons of cargo have been transported via the NSR in the first nine months of the year, consisting of 79 voyages. A significant 95% of the cargo originated from Russia, with crude oil accounting for 62%, bulk shipments for 27%, and containerized cargo for 6%. Among the voyages, 28 were from Russia to China, 26 from China to Russia, and 25 between Russian ports. Out of the total transit voyages, 46 were made by vessels transporting cargo, with 31 heading east and 15 going west, while the remaining 33 voyages were in ballast.

However, the CHNL has raised concerns about the increasing size and age of vessels navigating these icy waters, which poses additional risks. As ice formation is expected to occur earlier this year, transit operations will soon come to a halt, with restrictions on non-ice-class vessels starting on October 15.

------------------------------------------------------------------------------------------------

[SLOW] Weekly Clean Tanker Research _ Clean MR Newbuilding Price

Mercuria expands fleet with six new tanker orders in China

Swiss commodity trading firm Mercuria has placed an order for six medium-range (MR) tankers, each with a capacity of 41,000 deadweight tons, from China Merchants Jinling Shipyard. Delivery is expected between 2026 and 2028, although the price has not been disclosed. New MR tankers currently cost around $51.5 million, up from $46.9 million the previous year. Earlier in 2023, Mercuria also ordered two Panamax product tankers and one VLCC from Chinese shipyards, continuing its expansion in shipping assets. Mercuria's owned fleet currently comprises 37 vessels, including bunker and suezmax tankers.

------------------------------------------------------------------------------------------------

Maersk predicts global CO2 levy for shipping to be approved by 2025

A.P. Moller-Maersk A/S, a major player in the shipping industry, expects the International Maritime Organization (IMO) to approve a global carbon dioxide (CO2) levy on vessels by 2025. Talks in London have focused on new regulations to reduce the shipping sector's greenhouse gas (GHG) emissions, which account for around one billion tons of CO2 annually. The IMO is expected to finalize these regulations in 2024, with implementation set for 2027. A potential pricing mechanism on emissions could impose significant costs on the industry. Maersk supports a phased approach to emission charges, with figures like $60 per ton suggested, though higher, inflexible charges are seen as impractical. The shipping industry, responsible for over 80% of world trade, is moving toward leading the global energy transition.

Comments