2024.09.27

- SLOW

- 2024년 9월 27일

- 5분 분량

Saudi Arabia drops $100 oil target to regain market share as OPEC+ prepares output hike

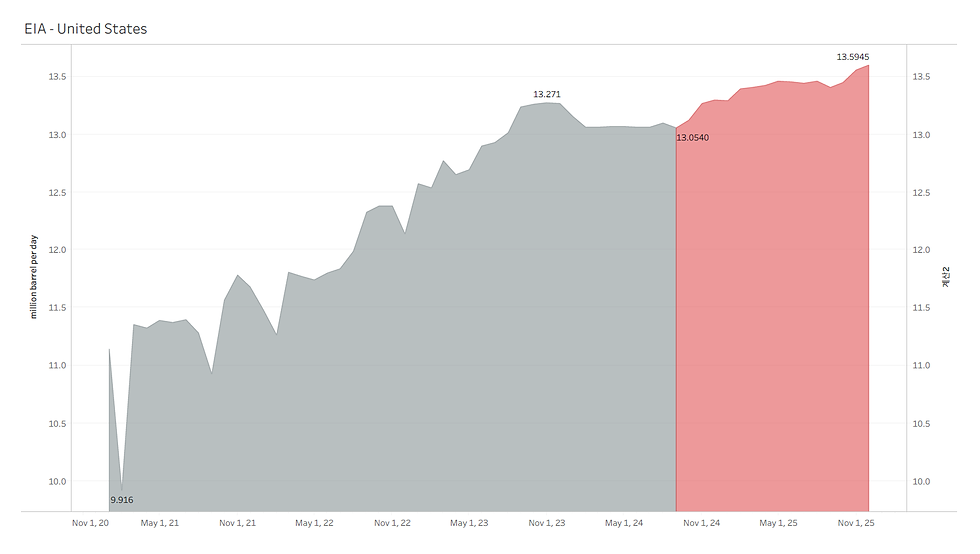

Saudi Arabia is set to abandon its unofficial target of $100 per barrel for crude oil in a bid to regain market share by increasing output, even at the expense of lower prices, according to a report by the Financial Times. The kingdom, which leads the OPEC+ alliance, has been reducing oil production alongside allies like Russia to support prices, but a surge in supply from other producers, notably the U.S., and weak demand growth in China have driven prices down by nearly 5% this year.

OPEC+ postponed planned production hikes for October and November after prices hit a nine-month low but plans to raise output by December 1, despite the likelihood of prolonged lower prices. Saudi Arabia's crude production currently accounts for less than 10% of global oil supply, while U.S. output has risen to 20%. Riyadh, which has shouldered significant production cuts since 2022, appears ready to prioritize market share over price stability, believing it can endure a period of lower prices through various funding sources.

OPEC+ continues to cut output by a total of 5.86 million barrels per day, approximately 5.7% of global oil demand. Historically, Saudi Arabia has boosted production to defend its market share, including a price war with Russia in 2020 and resisting calls for cuts in 2014 during the U.S. shale boom. OPEC and Saudi officials maintain that their production decisions are based on market fundamentals, not price targets.

[SLOW] EIA - Crude Oil Outlook _ United States

------------------------------------------------------------------------------------------------

UK sanctions five Russian LNG ships in latest crackdown on Arctic projects

The UK has imposed sanctions on five ships and two companies involved in transporting Russian LNG, particularly from Arctic projects like Novatek’s Arctic LNG 2. This marks the first time the UK has used new powers to specifically target LNG carriers, following earlier sanctions on oil tankers. The blacklisted vessels include Pioneer, Asya Energy, Nova Energy, North Sky, and La Perouse, with management companies Ocean Speedstar Solutions and White Fox Ship Management also sanctioned. The sanctions aim to restrict Russian LNG operations, a critical funding source for the war in Ukraine. The UK government continues to pressure Russia’s growing LNG sector, which seeks to expand its global market share from 8% to 20%.

------------------------------------------------------------------------------------------------

[SLOW] https://slowspace.io/ Trade Flow Libyan seaborne crude exports by destination countries

Libyan faction deal offers hope for Aframax shipowners

Aframax tanker rates, which have struggled due to a month-long blockade of Libyan crude exports, may see a recovery as Libya's eastern and western factions have struck an agreement on appointing a new central bank governor. This deal is seen as a key step toward resolving a dispute that has cut Libyan oil production by 700,000 to 800,000 barrels per day. Aframax rates have dropped below $20,000 per day for the first time since October 2023, continuing a decline from a June peak of $58,200 per day. A resolution to the Libyan production halt could boost aframax rates, which have been hurt by the outage. However, Libya's oil supply remains restricted, with September exports falling drastically, and broader market risks include Chinese import weakness. Despite this, global crude tanker demand is expected to rise in the coming years as OPEC+ production cuts unwind.

[SLOW] Aframax Market Monitor _ Global : Weekly Lifting Count

------------------------------------------------------------------------------------------------

Singapore fuel oil stockpiles plunge to near six-year low amid tight supplies

Fuel oil inventories in Singapore have dropped to 15.53 million barrels, the lowest level since October 2018, marking a 16% decline from the previous week, according to Enterprise Singapore. The decline in stockpiles reflects tightening supplies across Asia, exacerbated by firm demand for high sulfur fuel oil (HSFO) in bunkering markets. While spot demand has drawn down inventories, anticipated resupply has not materialized, according to analysts like Emril Jamil from LSEG Oil Research. The market remains in backwardation, with spot prices exceeding future prices, and strong premiums for both low sulfur and high sulfur fuel oils amid tight availability of blending components.

[SLOW] Oil Market HSFO Singapore, Fujairah, Rotterdam, and Houston

------------------------------------------------------------------------------------------------

[SLOW] Tanker Fleet Study _ Fuel type of VLCC by built year

Shipping industry faces push to clean up emissions with new fuels and regulations

The global shipping industry, responsible for 80% of world trade and 3% of human-made carbon emissions, is under pressure to achieve net-zero greenhouse gas emissions by 2050. While some companies are investing in alternative fuels like methanol, ammonia, and biofuels, the vast majority of the fleet still relies on oil-based fuels. The shift to cleaner alternatives faces challenges, including limited supply, competition from other sectors, and the complexity of decarbonizing massive vessels.

Potential replacement fuels each have pros and cons. Methanol can significantly reduce emissions, but clean versions are in short supply. Ammonia emits no CO2 but poses safety risks, while biofuels offer a viable short-term solution but face supply constraints. LNG cuts CO2 emissions but still contributes to methane pollution. Nuclear power is an option, but regulatory hurdles and public perception remain obstacles.

The International Maritime Organization (IMO) has set ambitious but non-binding targets for emissions reduction, with new rules expected by 2027. The European Union is also pushing decarbonization with its Emissions Trading System (ETS) and upcoming regulations. Additionally, initiatives like Green Shipping Corridors and Poseidon Principles aim to drive industry-wide changes.

Despite progress, over 90% of ships still run on conventional, oil-based fuel, indicating that the industry has a long way to go to meet climate targets. The coming years will be pivotal as new regulations take effect and shipping companies explore more sustainable solutions to lower their carbon footprint.

------------------------------------------------------------------------------------------------

Stolt Tankers expands Asian chemical fleet with new Japanese partner

Stolt Tankers has enhanced its Asian chemical tanker fleet by adding a vessel from Japan’s SU Navigation to its Stolt NYK Asia Pacific Services (SNAPS) operation, which is a collaboration with NYK Line and ENEOS Ocean Corp. This move reflects Stolt Tankers' strategy of pursuing asset-light fleet growth through partnerships, aimed at improving operational efficiency and profitability. President Maren Schroeder emphasized the importance of this addition in maintaining competitive service in the region.

The newly integrated vessel adheres to rigorous environmental and safety standards, aligning with the pool's sustainability goal of halving carbon intensity from a 2008 baseline. The tanker joined the SNAPS pool in early September, and SU Navigation, established in 2004, now manages seven chemical and product ships, with four built post-2020.

In addition, last year, Stolt-Nielsen and NYK welcomed ENEOS Ocean to their partnership, which contributed two 12,000-dwt carriers to the SNAPS pool. Stolt Tankers and NYK have a longstanding partnership, with their joint ventures managing a combined fleet of 19 chemical carriers.

Comments