2024.09.19

- SLOW

- 2024년 9월 19일

- 5분 분량

VLCC rates rise despite decline in US crude exports

VLCCs continue to see rising rates, even as US crude oil exports decline. As of Wednesday, the Clarksons fleet weighted average VLCC rate increased to $40,700 per day, marking a 2.1% rise from Tuesday and a 4.3% gain from the previous week. Rates have surged due to increased shipping demand from the Middle East and West Africa, though US Gulf to China rates have lagged behind, showing a slight decline. Despite a 16% year-over-year drop in US crude exports in August and further decreases in early September, VLCC rates have seen an 8.2% increase from the previous week. West Africa to China remains the highest-earning route for VLCCs, with rates reaching $42,100 per day for eco-designed vessels and $45,400 for scrubber-fitted ships. On Tuesday, Tankers International reported that Sinokor’s 300,000-dwt Gustavia S (built 2020) was fixed to Shandong Port Group for a voyage from the Caribbean to China, at a rate of $43,150 per day, with loading scheduled for mid-October. Additionally, the pool noted that the Koch-chartered, Pan Ocean-linked 300,000-dwt Grand Bonanza (built 2021) was fixed to PTT for a voyage from the Middle East Gulf to Thailand at $34,996 per day, with loading set for early October. VLCC rates have begun to rise as the fall refinery maintenance season ends and charterers seek to secure cargoes.

[SLOW] Daily VLCC Market _ VLCC TCE comparison by routes

------------------------------------------------------------------------------------------------

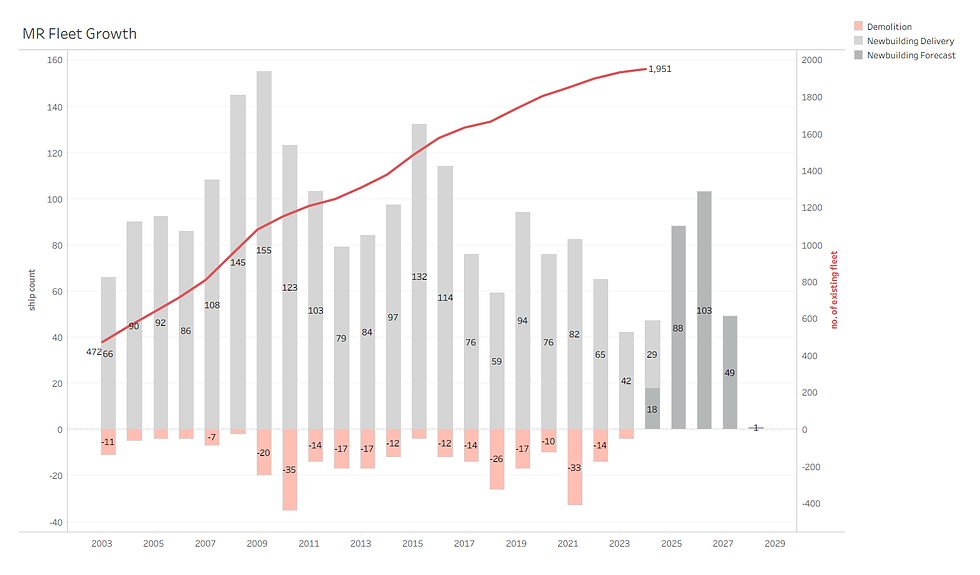

Profitable MR tanker market continues

Milan-listed d’Amico International Shipping (DIS) has secured a profitable two-year charter for one of its MR2 tankers, leveraging growing demand in the medium-range (MR) tanker market. This follows a similar move by US-listed Scorpio Tankers, which recently secured a record-breaking three-year charter at $29,950 per day. Although DIS did not disclose the exact terms of its charter, CEO Carlos di Mottola highlighted that the deal aligns with DIS's strategy to increase long-term contract coverage, ensuring stable earnings amidst strong market conditions. DIS has already locked in a significant portion of its fleet for the coming years at favorable time charter equivalent (TCE) rates, reflecting the robust tanker market. Tanker brokerage BRS estimates one-year time charter rates for eco MR2s at around $28,500 per day, with rates slightly decreasing over longer periods.

[SLOW] Tanker Fleet Study _ MR demolition / newbuilding delivery

------------------------------------------------------------------------------------------------

Trafigura expands VLCC newbuilding orders at Chinese shipyard

Swiss commodities giant Trafigura has placed an additional order for a VLCC at China's Jiangsu New Hantong Ship Heavy Industry, increasing its total order to six tankers at the shipyard. The earlier five orders were made in February and April 2024, and prices are speculated to be around $120 million per vessel. These newbuilds, set for delivery between 2026 and 2027, are dual-fuel and ammonia-ready. Trafigura made a significant investment of $286 million in May to order four ammonia-fueled LPG carriers from HD Hyundai Mipo. These 45,000-cbm vessels, set for delivery in 2027, will be capable of using low-carbon ammonia as fuel and transporting both LPG and ammonia. Trafigura, one of the largest vessel charterers globally, oversees over 5,000 shipping and chartering voyages annually. In 2023, the company managed 400 ships and traded 6.3 million barrels of oil and petroleum products per day. Its owned fleet includes 30 vessels, featuring suezmax tankers, VLGCs, midsize LPG carriers, and specialized tankers.

[SLOW] Tanker Fleet Study _ Tanker top 30 ship operators by total DWT

------------------------------------------------------------------------------------------------

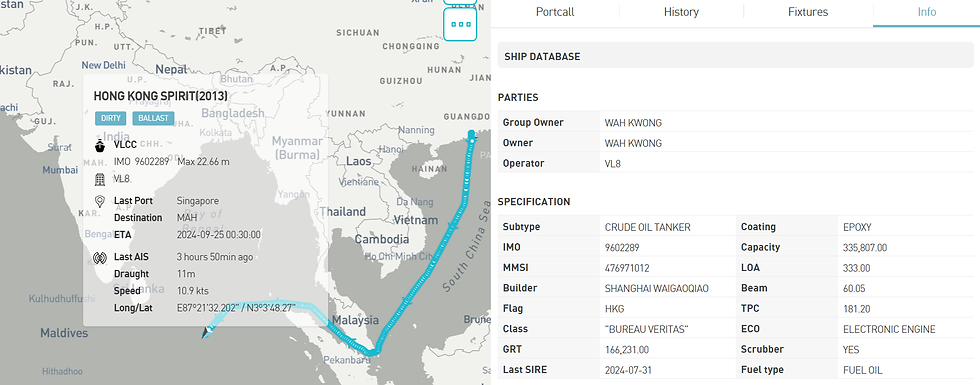

[SLOW] https://slowspace.io/ MT Hong Kong Spirit ship database

Wah Kwong’s VLCC joins Tankers International pool from Navig8

Wah Kwong, a Hong Kong-based shipping company, has joined Tankers International’s VLCC pool, adding its 318,700-dwt vessel Hong Kong Spirit (built 2013) to the fleet. Previously part of Navig8's VL8 pool since 2018, the ship is 50% owned by Teekay Tankers. Tankers International highlighted the benefits of pooling, including improved cash flow, better charter terms, and broader market access. Wah Kwong, with a diverse fleet of bulkers, gas carriers, and box ships, views the partnership as a hedge against the shipping industry’s volatility while providing stable returns. This move maintains Tankers International’s average fleet age to 11.2 years.

------------------------------------------------------------------------------------------------

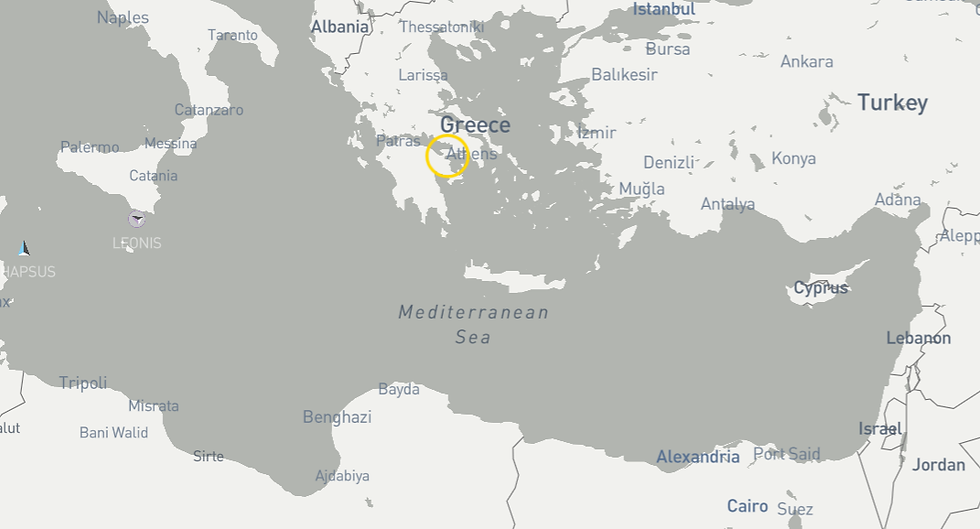

[SLOW] https://slowspace.io/ _ Port Agioi Theodoroi

Fire forces Greek refinery to cut production and reduce tanker traffic

A major Greek refinery operated by Motor Oil, which normally handles over 30 tankers per month, has significantly reduced production following a fire that caused serious damage to its facilities. The blaze, extinguished early Wednesday, affected one of the refinery's two crude distillation units (CDU), which will require repairs lasting several weeks or possibly months. As a result, the refinery is expected to cut crude oil imports and increase alternative feedstock purchases for its upgrading units. Despite the disruption, Motor Oil is fully insured for material damage and income losses. The cause of the fire remains unknown, though three subcontractor workers sustained minor injuries. Data from the Signal Ocean shows that Motor Oil’s Agioi Theodoroi terminal has registered approximately 180 port calls over the past six months. Of these, 60% were made by MR1 product tankers, while MR2 tankers and suezmaxes each accounted for 13%. The average waiting time for vessels at the terminal is about 2.2 days.

[SLOW] https://slowspace.io/ Port Agioi Theodoroi cargo flow

------------------------------------------------------------------------------------------------

Russian insurers increase role in facilitating oil exports to India amid western sanctions

Russian insurers are playing an increasingly important role in supporting Moscow's oil shipments to India, its largest oil buyer, amid Western sanctions. In July 2023, Russian firms insured 60% of oil cargoes heading to India, up from 40% in December 2022. This allows Russia to sell oil above the $60 per barrel price cap imposed by the G7, EU, and Australia. Companies like Ingosstrakh, Rosgosstrakh, and Alfastrakhovanie are providing marine insurance, previously dominated by Western insurers before the Ukraine war. While 40% of Indian-bound shipments still rely on Western insurance, Russian-linked shipping firms often use domestic insurers. India overtook China as Russia’s top oil buyer in July, driven by seaborne deliveries.

[SLOW] https://slowspace.io/ Trade Flow India seaborne crude imports from Russia by origin ports

------------------------------------------------------------------------------------------------

Japan’s crude oil imports drop 15% in August, LNG and coal imports rise

Japan’s customs-cleared crude oil imports fell by 15.2% in August 2023 compared to the same month in the previous year, with the country importing 2.33 million barrels per day (11.472 million kilolitres), according to the Ministry of Finance. Despite the decline in crude oil, Japan's liquefied natural gas (LNG) imports rose by 1% to 5.729 million tonnes, while thermal coal imports for power generation surged by 10.3%, reaching 9.251 million tonnes. The figures reflect Japan's shifting energy mix, balancing oil with increased imports of LNG and coal.

------------------------------------------------------------------------------------------------

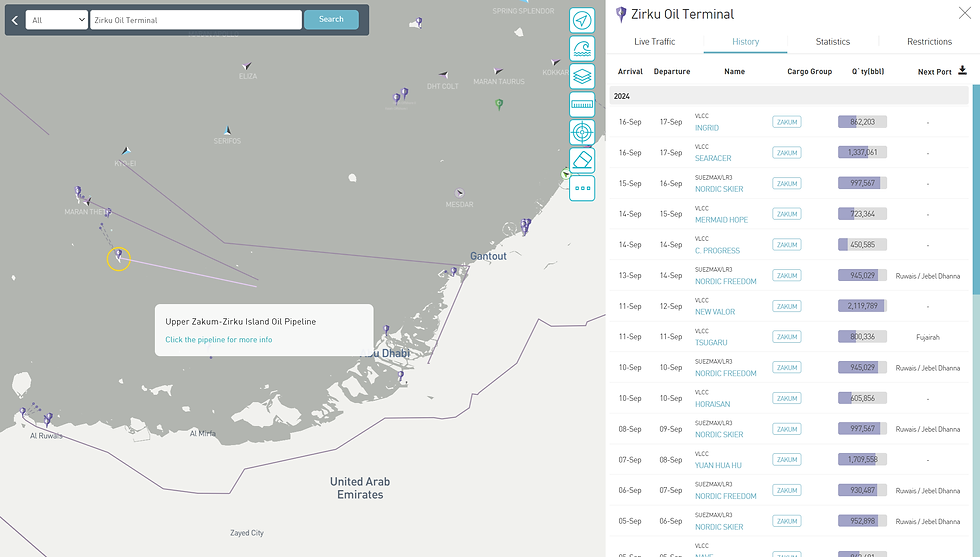

Dubai and Oman crude prices strengthen as Unipec and Sinochem snap up Upper Zakum cargoes

Spot premiums for Middle East crude benchmarks Dubai and Oman rose on Wednesday due to strong demand from Chinese refiners and Mitsui. Unipec bought at least four November-loading Upper Zakum crude cargoes at premiums just above $2 per barrel to Dubai quotes. Sinochem also purchased two cargoes at comparable price levels. Meanwhile, Iraq's SOMO plans to sell up to 2 million barrels of heavy sour Qaiyarah crude through the Platts Asia Market on Close assessment, after an earlier tender for prompt loading failed to attract buyers.

LOW] https://slowspace.io/ Zirku Oil Terminal Upper Zakum-Zirku Island Oil Pipeline

Comments