2024.09.17

- SLOW

- 2024년 9월 18일

- 5분 분량

[SLOW] https://slowspace.io/ Westridge Marine Terminal cargo flow

Trans Mountain Pipeline boosts Canadian oil exports to Asia, reduces US and Spain shipments

Canada's newly expanded Trans Mountain pipeline, operational since June, is redirecting crude oil flows from the US Gulf to Asia, fulfilling the project's goal of diversifying Canada’s oil market beyond US buyers. Since the expansion, Canada has shipped 28 million more barrels of crude from its west coast, with the majority going to China, India, South Korea, and Brunei. Since the Trans Mountain pipeline expansion began, China has increased its purchases of Canadian crude by 8.24 million barrels, including 11.6 million barrels from Canada's west coast and a reduction of 3.35 million barrels from the Gulf Coast. South Korea has bought 3.91 million more barrels from the west coast, while India increased its west coast imports by 1.53 million barrels and also purchased an additional 1.23 million barrels from the Gulf Coast. The shift has reduced US Gulf shipments by 1.68 million barrels. The pipeline, nearly tripling its capacity to 890,000 barrels per day, aims to reduce Canada’s dependency on American refiners, who often impose steeper price discounts. Spain, previously the fourth-largest foreign buyer of western Canadian oil, reduced its Gulf Coast purchases by 352,000 barrels and did not increase imports from Canada's west coast. Spain had relied more on Canadian crude due to supply uncertainties from Mexico and Venezuela. However, Repsol SA, Spain’s main importer of Canadian crude, obtained a US license to resume operations in Venezuela after sanctions were reimposed. As a result, Venezuelan crude exports to Spain, which are similar to Canadian heavy oil, doubled in August.

------------------------------------------------------------------------------------------------

NYK aims for 120-LNG fleet by 2027 amid global energy shift

NYK, the Japanese shipping giant, plans to expand its LNG fleet to over 120 vessels by 2027, seeing LNG as a long-term energy source that will remain relevant beyond the green energy transition. NYK currently manages 60 LNG carriers in its fleet, but this number is expected to increase to 90 vessels within the next two to three years. With more than 25 LNG carriers already on order, NYK has secured slots in major projects, including QatarEnergy’s LNG expansion. However, the company is cautious about expanding too rapidly, emphasizing the need to maintain high-quality operations and human resources. Rising shipbuilding costs and changing market dynamics are pushing NYK towards longer-term charter agreements of over 15 years. NYK also plans to replace older steam turbine LNG carriers with more efficient vessels as emission regulations tighten. Additionally, NYK is exploring new technologies for fleet decarbonization, including carbon capture and storage (CCS), and is considering entering the floating storage and regasification (FSRU) sector.

[SLOW] Oil Market _ LNG Price

------------------------------------------------------------------------------------------------

[SLOW] LR2 Market Monitor _ TCE comparison by routes

Crude tankers entering product markets impact LR2 rates by $17,000 per day

The influx of crude tankers into the product tanker market reduced LR2 spot rates by about $17,000 per day in the third quarter, according to Clarksons. LR2s earned an average of $38,000 per day, down from the $55,000 they would have made without competition from around 4 million deadweight tons of crude tankers, which moved into product transport due to lower crude tanker demand during the summer. Major operators like Frontline and Trafigura shifted suezmaxes and VLCCs into clean trades, contributing to this dynamic. However, analysts expect this trend to be short-lived, with crude oil overproduction projected to improve refinery margins by 2025 and stabilize the supply-demand balance for product tankers through 2025, with no significant market weakness anticipated until 2026.

------------------------------------------------------------------------------------------------

[SLOW] Oil Market North Sea Oil Price Ural

Western tanker owners poised to benefit as Russian crude prices fall below G7 Cap

The drop in Russian Urals crude prices towards the G7 price cap of $60 per barrel could be a "double positive" for Western tanker owners, according to US shipbroker Poten & Partners. Initially, the price cap, imposed in December 2022, had little effect as Urals crude traded below $60. However, as prices rose in mid-2023, Western tanker owners faced increasing pressure, leading many to exit Russian trades. With Urals prices now falling again, it may allow Western tanker owners to re-enter the market, improving fleet utilization and marginalizing the "dark fleet" of tankers with opaque ownership, poor maintenance, and insufficient insurance. This shift could stabilize freight rates and bring benefits to mainstream tanker companies.

------------------------------------------------------------------------------------------------

[SLOW] Weekly Dirty Tanker Research _ VLCC secondhand price by ages

Athenian Sea Carriers nears VLCC sale to complete shift toward chemical tankers

Athenian Sea Carriers, owned by Greece's Kyriakou family, is reportedly selling its last remaining VLCC, the 319,100-dwt Captain X Kyriakou (built 2013), in a deal valued at $80 million to a Norwegian buyer. This sale, if confirmed, would mark the final step in Athenian's transition from VLCCs to chemical tankers. Over the past few years, the company has divested its VLCC fleet, investing in a newbuilding program focused on chemical tankers, with 10 vessels under construction in China. The sale aligns with Athenian’s strategy to shift entirely into the chemical tanker market by 2027. Captain X Kyriakou would be the first VLCC sold in the secondhand market since mid-August, when Greek owner Evangelos Marinakis agreed to sell nine VLCCs in a $1 billion deal with Saudi company Bahri.

[SLOW] https://slowspace.io/ _ CAPTAIN X KYRIAKOU (2013)

------------------------------------------------------------------------------------------------

China's refinery output drops for fifth consecutive month as fuel demand remains weak

In August, China's oil refinery output decreased by 6.2% year-on-year, marking its fifth consecutive monthly decline due to weak fuel demand and poor export margins. Refineries processed 59.07 million metric tons of crude oil, averaging 13.91 million barrels per day (bpd), slightly up from July but significantly lower than last year’s rate of 15.23 million bpd. Year-to-date refinery output also fell by 1.2% compared to the same period last year. The decline in diesel fuel demand is attributed to an economic slowdown and the rise of liquefied natural gas as a truck fuel, while gasoline consumption has been disappointing despite seasonal peaks. Planned maintenance at major refineries and softening export margins have further restrained production. In contrast, crude oil production increased by 2.1% year-on-year, and natural gas production grew by 9.4% in August.

[SLOW] EIA - Crude Oil Outlook _ China oil production

------------------------------------------------------------------------------------------------

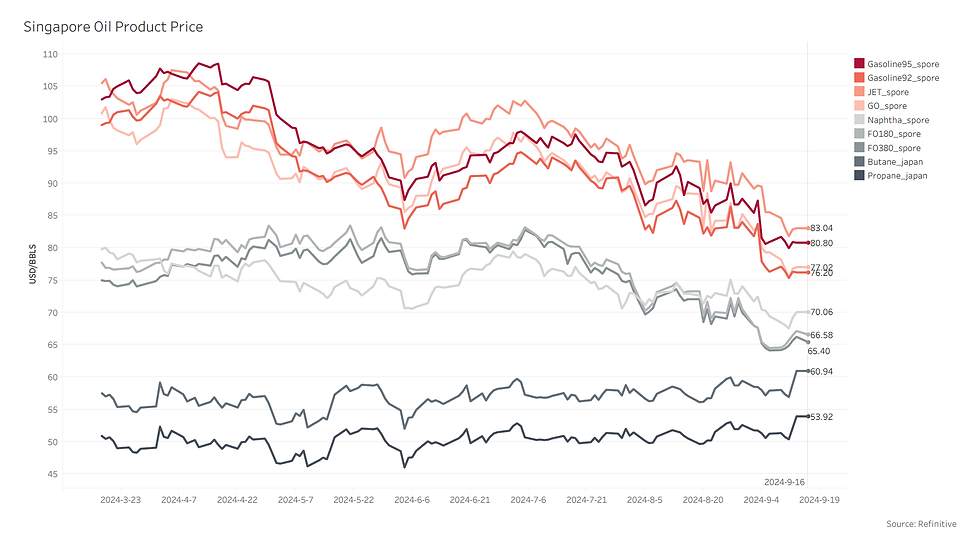

[SLOW] Oil Market _ Singapore oil product price

Singapore's August bunker fuel sales decline due to premiums, while marine biofuel hits record

In August, bunker fuel sales at Singapore, the world's largest bunker hub, decreased by 2.3% month-on-month, totaling 4.56 million metric tons. This dip was driven by reduced demand for conventional fuels, as higher bunker premiums and tight cargo availability shifted some spot demand to other Asian ports. However, sales of marine biofuels reached a record high of 67,800 tons. Sales of low-sulphur fuel oil (LSFO) fell by 1.7% from July, while high-sulphur marine fuel oil (MFO) saw a 4.8% decrease but a 21.7% increase compared to last year. Marine gasoil (MGO) sales declined by 1.2% month-on-month but rose by 8.6% year-on-year. Additionally, LNG bunker sales rebounded to 45,600 tons.

------------------------------------------------------------------------------------------------

NNPC raises petrol prices as Dangote Refinery begins fuel supply

Nigeria's state oil firm, NNPC Ltd, has increased petrol prices by 11%, marking the second price hike in two weeks. This adjustment follows the firm's recent procurement of fuel from the new Dangote refinery, which has begun operating on the outskirts of Lagos. The price of gasoline has risen from 858 naira ($0.53) to 950 naira in Lagos and up to 1,019 naira in the northeast. NNPC currently buys fuel from the Dangote refinery at 898 naira per litre. This increase is expected to exacerbate public dissatisfaction amid a severe inflation rate of 33.4% and ongoing economic challenges. The Dangote refinery, with a capacity of 650,000 barrels per day, is anticipated to reduce Nigeria's reliance on gasoline imports, ending a long period of subsidies that President Bola Tinubu began phasing out last year. Starting in October, NNPC will supply 385,000 barrels of crude daily to the refinery, with transactions transitioning to local currency.

[SLOW] https://slowspace.io/ Dangote Refinery cargo flow

Comments