2024.09.05

- SLOW

- 2024년 9월 11일

- 4분 분량

[SLOW] Oil Market _ WTI / Dubai / Brent

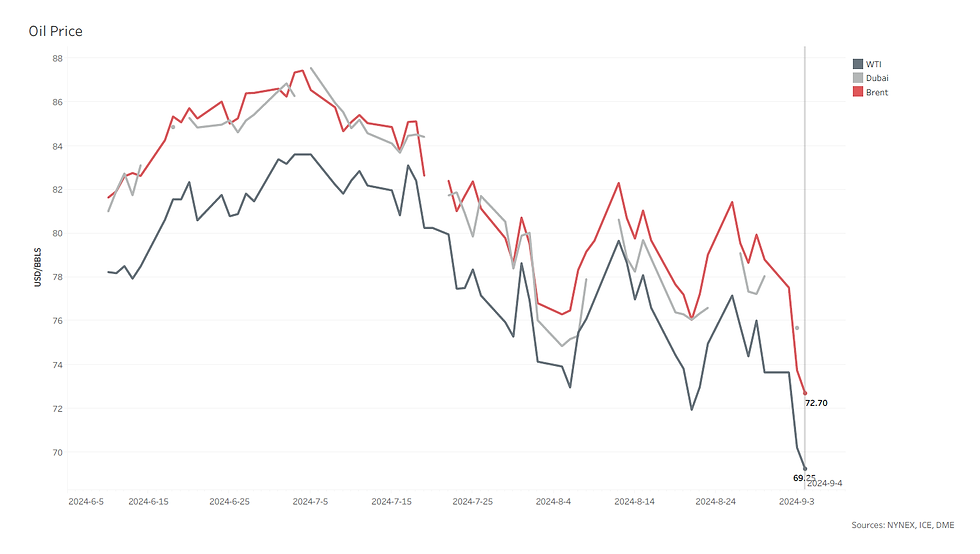

OPEC+ considers delaying October output increase amid oil price decline

OPEC+ is discussing postponing its planned oil output hike for October due to a steep decline in oil prices, which have hit a nine-month low. The price drop stems from global economic concerns, particularly weak economic data from China, the world's largest oil importer. Originally, OPEC+ had planned a 180,000 barrels-per-day (bpd) production increase as part of a gradual easing of previous output cuts. However, soft demand forecasts, concerns over increased supply, and a possible resolution to Libya's production dispute have led the group to reconsider. A delay in the output increase seems "highly possible," according to sources. Oil prices briefly rose on this news but later fell again. Some analysts suggest that OPEC+ may wait until December to reintroduce more barrels to the market, given current uncertainties.

------------------------------------------------------------------------------------------------

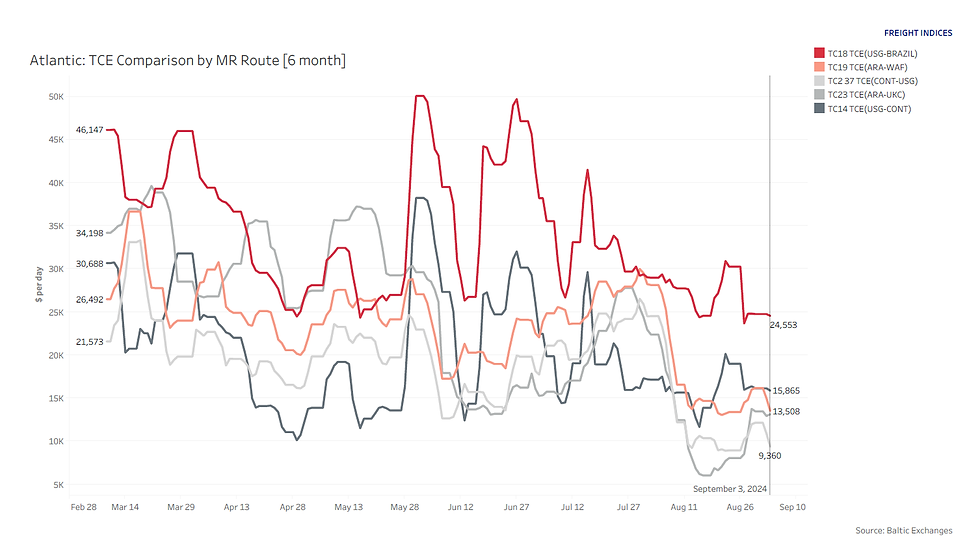

Mexican refinery launch shakes product tanker trade, reducing tonne-miles and imports

The launch of Mexico’s new 340,000-barrel-per-day Olmeca refinery in Dos Bocas is expected to significantly shift product tanker trade patterns, as Mexico reduces its reliance on oil product imports, particularly from the US. As the refinery becomes fully operational, imports of diesel and gasoil from the Middle East will also drop, analysts from Fearnley Securities predict. The refinery will source domestically produced crude, impacting US refineries that rely on medium and heavy grades, potentially increasing crude imports from Canada and the Middle East. This shift could reduce tonne-miles in the Atlantic trades. Currently, the refinery is processing 170,000 barrels per day, with expectations for increased output by the fourth quarter.

------------------------------------------------------------------------------------------------

Transatlantic diesel trade thrives despite declining European demand and green shifts

Despite a decrease in European diesel demand due to the shift toward environmentally friendly vehicles, the transatlantic diesel tanker trade remains robust, according to US shipbroker Poten & Partners. The trade's long-standing pattern, driven by Europe's diesel shortage and the US's surplus, continues to be profitable for MR tankers. However, changing dynamics, such as sanctions on Russian diesel—which previously supplied nearly 50% of Europe’s imports—have led to increased imports from the US, Saudi Arabia, and even Asia. The geopolitical situation, including Russia's war in Ukraine, has reignited the transatlantic trade, leading to an increased demand for larger tankers. While long-term European diesel demand is expected to decline, current geopolitical tensions have extended the life of this trade.

------------------------------------------------------------------------------------------------

An Aframax loading crude at Libyan port despite blockade halting crude exports

Despite a blockade halting crude exports at major Libyan ports, the 600,000-barrel oil tanker Front Jaguar was loading oil from storage at Libya's Brega port on Wednesday. The blockade, initiated by eastern Libyan authorities on August 26 in response to a political dispute over the control of the Central Bank of Libya (CBL), has caused a significant drop in Libya's oil production. While some ports like Zueitina remain shut, engineers expect propane loading to resume soon. Oil output has plummeted to around 590,000 barrels per day, and the National Oil Corporation (NOC) has declared force majeure at key fields like El Feel. Despite the crisis, limited production is resuming at certain fields, such as Sarir and Messla, though the ongoing tensions threaten Libya's fragile stability.

------------------------------------------------------------------------------------------------

[SLOW] EIA - Crude Oil Outlook _ Venezuela crude oil production

Spain’s crude oil imports from Venezuela surge, surpassing 2023 levels

Spain's crude oil imports from Venezuela have surged in 2024, already surpassing last year's total. By July, Spain had imported 1.7 million tons of Venezuelan crude, nearly triple the amount from the same period in 2023 and exceeding the previous year’s total of 1.4 million tons. This increase comes as Venezuela's oil exports rise, aided by U.S. licenses allowing state oil company PDVSA to export. Spain’s largest oil company, Repsol, has been importing more oil from PDVSA as part of a U.S.-authorized deal, using crude as payment for Venezuela's outstanding debt to the company.

------------------------------------------------------------------------------------------------

[SLOW] https://slowspace.io/ _ Northern Sea Route

Putin sees new Russian shipyard as nation plans to expand tanker and gas carrier fleet

Russian President Vladimir Putin visited a new shipyard near Russky Island in Vladivostok, marking Russia’s efforts to expand its cargo fleet, including bulkers, tankers, container ships, and gas carriers. The shipyard, which aims to produce 12 vessels annually, is part of Russia's strategy to bolster its shipping capacity, especially after facing order cancellations for LNG carriers at South Korean yards due to sanctions linked to the Ukraine war. Russia has decommissioned 580 vessels over the past two decades while building only 224. The new facility is crucial for advancing Putin's Northern Sea Route ambitions, which aim to transport 80 million tonnes of cargo this year, growing to 220 million tonnes by 2035. Military shipbuilding remains a priority for Russian shipyards, limiting capacity for cargo ship production.

Comments