2024.08.30

- SLOW

- 2024년 9월 11일

- 4분 분량

Record level diesel shipments to Europe and Africa on supertankers amid Asian surplus

Traders are transporting record volumes of diesel from Asia to Europe and Africa using VLCCs in August, a trend expected to continue into September. Five supertankers — Maran Leo, Sea Lion, Nissos Keros, Nissos Nikouria, and Atherina — have loaded over 9 million barrels of diesel from the Middle East and India. This shift is driven by cost advantages in using VLCCs for refined fuels, with rates significantly cheaper than those for clean tankers. The move also reflects weaker demand for crude in Asia, particularly from China, freeing up VLCCs for other cargoes. This strategy helps ease an Asian diesel surplus and supports markets in the West facing supply shortfalls, especially ahead of refinery maintenance and winter demand.

[SLOW] https://slowspace.io/ Five supertankers Maran Leo, Sea Lion, Nissos Keros, Nissos Nikouria, and Atherina

------------------------------------------------------------------------------------------------

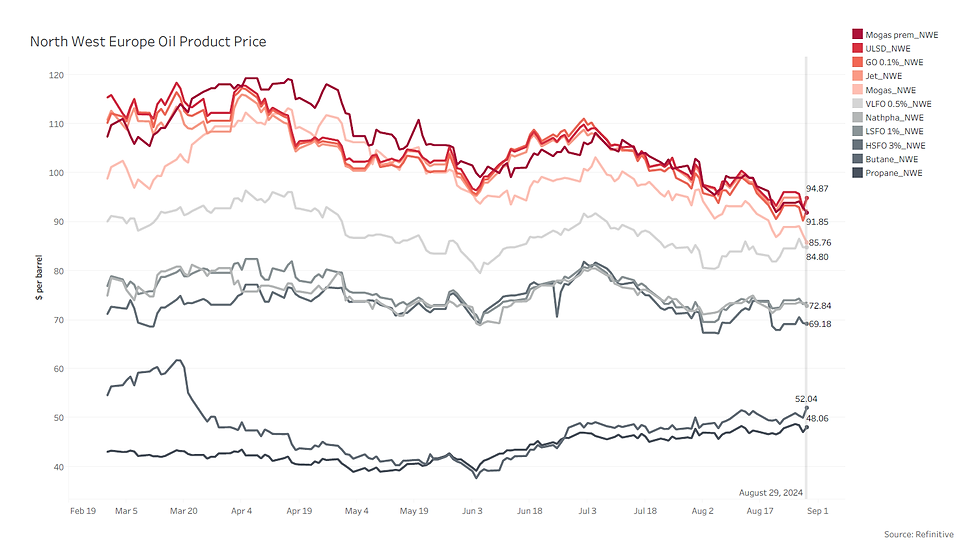

European diesel profits plummet as market faces weakest margins in over a year

The profitability of producing diesel in Europe has hit a 15-month low, with the ICE Gasoil crack — the premium of diesel over crude oil — dropping to $14.22 per barrel, its lowest since May 2022. This decline is driven by weak consumption and an influx of diesel from supertankers, with demand expected to worsen in 2024, even below pandemic levels. Diesel futures are also showing signs of oversupply, with a deepening contango structure, where future contracts are priced higher than current ones, indicating that supply is outstripping demand.

------------------------------------------------------------------------------------------------

VLCC spot earnings hit 2024 low as Unipec charter deepens market downturn

VLCC spot earnings have plunged to their lowest level of 2024, with rates dropping 7.7% on Thursday, reaching $26,400 per day. This decline erases gains made earlier in August and marks the lowest point since the end of last year. Among the day's fixtures, Unipec, a major Chinese refiner in the VLCC market, secured the 319,000-dwt Agios Nikolas (built in 2019) for a voyage from the Middle East to China at a rate of just over $23,000 per day, according to Tankers International. The scrubber-fitted vessel is owned by Greece’s Enesel but is commercially managed by the Swiss trading house Mercuria. The ongoing decline highlights the challenging conditions in the VLCC market, with current earnings falling below break-even rates for some operators.

[SLOW] Daily VLCC Market _ VLCC TCE comparison by routes

------------------------------------------------------------------------------------------------

[SLOW] Weekly Dirty Tanker Research _ Ship scrap price

Aframax linked to sanctioned trades sold for scrap at a low price

The Aframax tanker Prada (built 2001), linked to illicit oil trades and facing multiple sanctions-related complications, has been sold for recycling at a significantly low price of $9 million. The vessel, previously valued at $26 million as a trading ship, was unable to trade since March 2023 due to its controversial history, including allegations of carrying US-sanctioned Iranian crude and flag fraud involving Panama, Cameroon, and Eswatini. The ship was also abandoned by its owner, leaving the crew unpaid and stranded. The sale reflects broader challenges in dealing with aging "dark fleet" tankers tied to sanctioned activities, with few buyers and shipyards willing to engage due to the risks of US sanctions.

------------------------------------------------------------------------------------------------

Sovcomflot’s profits plummet amid sanctions pressure, despite strong tanker market

Russian state-owned shipowner Sovcomflot (SCF Group) reported a significant drop in profits for the first half of 2024 due to the impact of Western sanctions. Net profit fell to $324 million, down from $496 million in the same period in 2023, while operating profit from tankers and LNG carriers also decreased. Revenue dropped to $1 billion, and operating costs rose. Despite these challenges, the company benefited from long-term contracts and a strong tanker market. Sovcomflot is actively addressing operational issues related to its sanctioned fleet, while noting that ship values and freight rates remain high due to reoriented trade flows.

------------------------------------------------------------------------------------------------

Trafigura secures Biofuels supply deal to meet EU Maritime Decarbonization targets

Trafigura has signed a deal with John Fredriksen-backed companies to supply B30 - blend that contains 30% fatty acid methyl esters, also known as FAME or biodiesel - in key bunkering hubs, including Singapore and the Antwerp-Rotterdam-Amsterdam region, to comply with the EU's upcoming FuelEU Maritime regulations. These rules, starting in January, will impose stricter limits on the carbon intensity of ship fuels. The agreement, covering 2025, aligns with Trafigura’s strategy to use biofuels as a primary measure to reduce shipping emissions. Trafigura, which aims to cut its fleet's greenhouse gas intensity by 25% by 2030, sees biofuels and other low-carbon alternatives like ammonia as essential to meeting decarbonization goals.

------------------------------------------------------------------------------------------------

Houthis permit tugboat access to fire-damaged tanker in Red Sea amid environmental concerns

The Houthi group in Yemen has agreed to allow tugboats and rescue ships access to the damaged Sounion, a crude oil tanker attacked by the group in the Red Sea. This decision was made after several international parties, including Iran, requested a temporary truce due to humanitarian and environmental concerns. The Sounion, which was carrying 922,000 barrels of Iraqi crude, remains immobilized and poses a significant environmental risk. The attack is part of the Houthis' broader campaign linked to their support for Palestinians in the ongoing conflict between Israel and Hamas.

[SLOW] https://slowspace.io/ _ Sounion

------------------------------------------------------------------------------------------------

Iraq to slash oil production in September to compensate for OPEC+ agreement

Iraq plans to cut its oil production to between 3.85 and 3.9 million barrels per day (bpd) in September to compensate for exceeding its OPEC+ quota earlier this year. This reduction, from July's production of about 4.25 million bpd, will tighten the oil market, especially as Libyan oil output falls due to political disputes. Iraq's plan includes reducing exports, cutting local consumption, and asking the Kurdistan Regional Government to reduce its output. This move is part of Iraq's commitment to the OPEC+ agreement to manage production levels, with further cuts expected as OPEC+ prepares to ease some production cuts in October.

Comments