2024.08.21

- SLOW

- 2024년 9월 11일

- 4분 분량

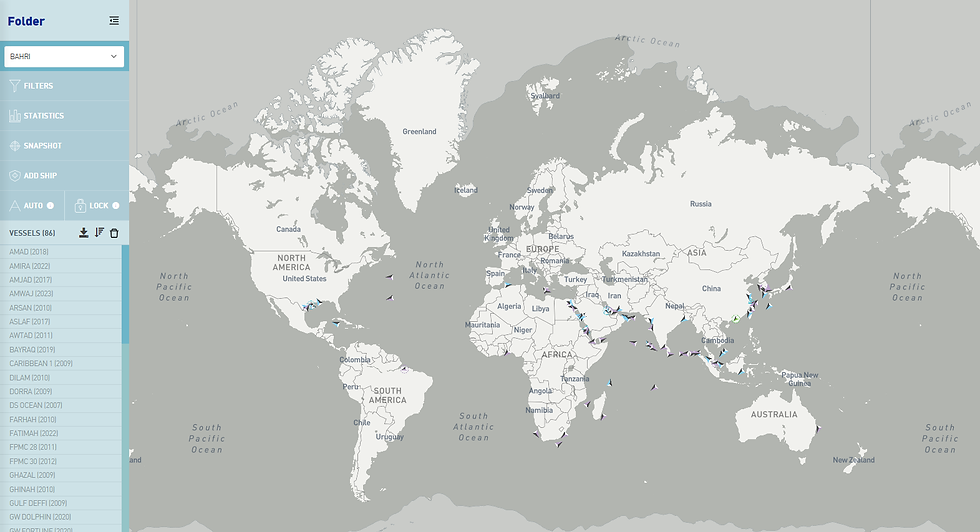

[SLOW] https://slowspace.io/ Folder Filters _ Bahri

Bahri purchases 9 VLCCs of $1 billion deal, making Bahri the second-largest VLCC owner

Greek shipowner Evangelos Marinakis has sold nine VLCCs to Saudi Arabia's national shipping carrier, Bahri, in a $1 billion deal. This acquisition, which is part of Bahri's fleet modernization strategy, will enable the company to phase out older vessels and become the second-largest VLCC fleet owner worldwide. The tankers, built in South Korea with an average age of 5.9 years, are equipped with scrubbers. Despite the sale, Marinakis retains a strong presence in the tanker market, with over 30 ships and newbuilds on order including six VLCCs. This transaction is the largest in the VLCC sector this year and reinforces Bahri's significant expansion efforts in the market.

------------------------------------------------------------------------------------------------

US West Coast refiners await cost benefits from Trans Mountain Pipeline as most cargoes flow to Asia

The expanded Trans Mountain (TMX) oil pipeline, which started operations in May, has so far had minimal impact on crude costs for U.S. West Coast refiners. Although the pipeline tripled capacity from Alberta to Canada’s Pacific Coast, much of the additional oil has been exported to Asia rather than reaching U.S. refineries as expected. Companies like Phillips 66 and Marathon Petroleum anticipated that Canadian heavy crude from TMX would lower their costs by replacing more expensive imports from Latin America and the Middle East. However, the initial flow has not significantly affected Western Canada Select (WCS) crude prices, nor has it displaced other sources of heavy oil. As Canadian heavy crude competes with Alaskan North Slope (ANS) and other crudes, some price pressure has been observed, potentially lowering costs for West Coast refiners in the coming months. Nonetheless, refiners are still evaluating whether integrating Canadian heavy sour crude will be efficient for their operations.

------------------------------------------------------------------------------------------------

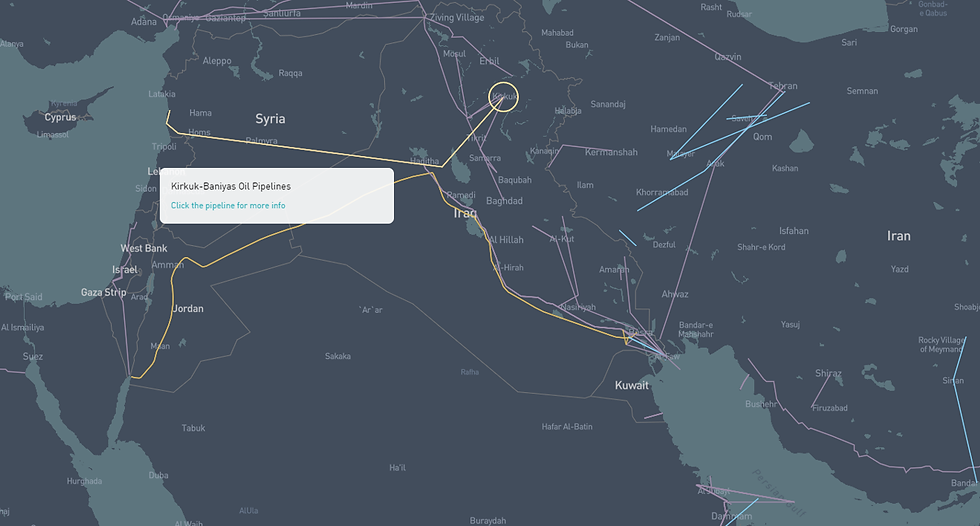

Iraq shifts to profit-sharing model in new BP deal for Kirkuk oil fields

Iraq has struck a preliminary deal with BP to develop the Kirkuk oil and gas fields using a profit-sharing model, moving away from the traditional low-margin service contracts that have previously deterred Western oil majors. This new agreement aims to accelerate production growth and attract companies like BP, which had left Iraq nearly five years ago due to unfavorable terms. The Kirkuk fields, estimated to hold 9 billion barrels of recoverable oil, will be the focus of this deal. BP's return marks a significant shift in Iraq's strategy to boost its oil output, currently the second-largest in OPEC, while stabilizing and potentially increasing production at Kirkuk, which currently yields about 245,000 barrels per day.

------------------------------------------------------------------------------------------------

[SLOW] Trade Flow https://slowspace.io/ Saudi Arabia seaborne crude oil export

Saudi Arabia's crude oil exports decline in June, following OPEC’s production cuts

In June, Saudi Arabia's crude oil exports fell slightly to 6.047 million barrels per day (bpd), down from 6.118 million bpd in May, according to the Joint Organizations Data Initiative (JODI). The decline comes as Saudi Arabia, the world's largest crude oil exporter, continues to navigate OPEC's production cuts and a shifting global demand landscape. Saudi crude production also dropped to 8.830 million bpd, and refinery throughput decreased by 0.523 million bpd to 2.423 million bpd. Despite these reductions, Saudi Arabia raised the price of its flagship Arab Light crude for Asia in September. The global market remains uncertain, with OPEC revising down its demand growth forecast, particularly due to weaker-than-expected consumption in China.

------------------------------------------------------------------------------------------------

[SLOW] LR2 Market Monitor _ LR2 TCE Comparison

Wah Kwong enters LR2 tanker market with $280 million deal for four newbuildings

Wah Kwong Maritime Transport Holdings, led by Hing Chao, is expanding into the LR2 product tanker market with its first tanker newbuilding contract in nearly a decade. The company has provisionally agreed to a $280 million deal with Hengli Heavy Industry in China to build four conventional aframax product tankers, each costing around $70 million. This move marks Wah Kwong's strategic entry into the LR2 segment, leveraging its experience with aframax crude carriers. The last time Wah Kwong ordered tankers was in 2014-2015. This order highlights the company's shift towards tankers, complementing its recent investments in ultramax bulk carriers and LNG carriers. Wah Kwong currently operates a diverse fleet of 23 ships and has evolved into an integrated shipping group with interests in ship management and operations.

------------------------------------------------------------------------------------------------

[SLOW] Daily VLCC Market _ VLCC TCE Comparison by Routes - 120 Days

VLCCs shifted to product tanker trades

As VLCC and suezmax tanker rates declined this summer, these large vessels, traditionally used for crude oil, increasingly moved into carrying petroleum products. According to Steem1960 Shipbrokers, uncoated tankers carried about 65 million tonnes, or 15%, of petroleum products in July and August—a record high in 25 years. This shift has negatively impacted the clean tanker market, particularly LR2 vessels, causing rates and earnings to drop significantly as VLCCs, which can carry more than a standard product tanker, flood the market. Although VLCC rates have recently rebounded slightly, they still lag behind earlier peaks. The market is expected to stabilize with the seasonally stronger northern hemisphere winter, but uncertainty remains, especially concerning Chinese demand. The broker anticipates a stronger correlation between clean and dirty petroleum product markets, with the clean market particularly vulnerable to further disruptions.

Comments