2024.08.16

- SLOW

- 2024년 9월 11일

- 3분 분량

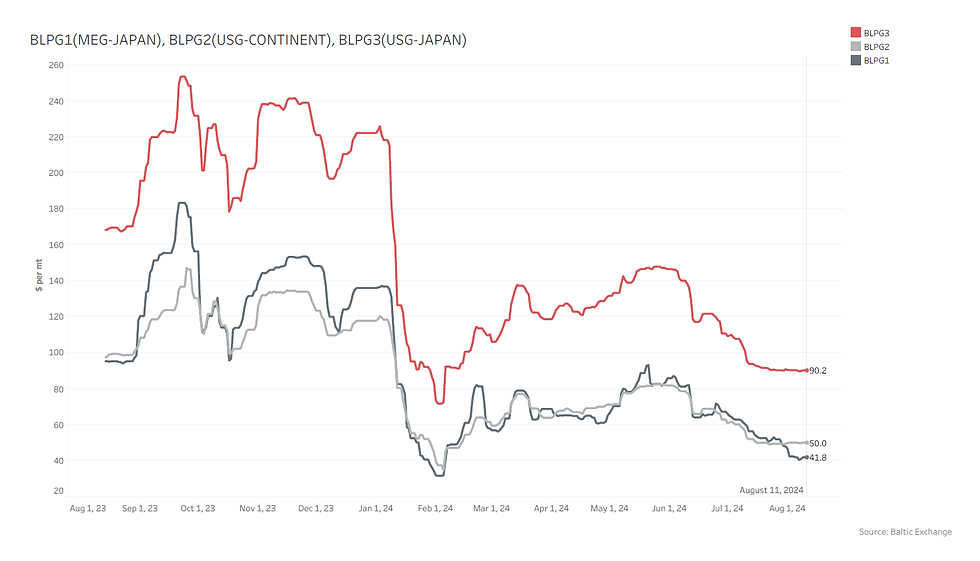

US sanctions 4 VLGCs for aiding Hezbollah and Houthi networks through Iranian oil trade

The U.S. Treasury Department has imposed sanctions on several ships, including four very large gas carriers (VLGCs), - 78,500-cbm Fengshun (built 1991), 84,300-cbm Victoria (built 1996), 78,500-cbm Lady Liberty (built 1993) and 77,700-cbm Parvati (built 1987) - linked to aiding Hezbollah, a group the U.S. considers an Iranian-backed terrorist organization. The ships are owned by Hong Kong-based Kai Heng Long Global Energy, which allegedly transported Iranian LPG to China for Hezbollah-controlled companies. Additionally, sanctions were imposed on vessels and entities associated with Yemen's Houthi network, accused of moving Iranian oil and LPG to support Houthi military activities. The sanctions aim to disrupt Iran's financial support for these groups.

------------------------------------------------------------------------------------------------

China's July oil refinery output hits lowest level since October 2022 amid weak demand and refinery overhauls

China's oil refinery output in July 2023 dropped by 6.1% compared to the previous year, reaching its lowest level since October 2022, due to low processing margins and weak fuel demand. Refiners processed 59.06 million metric tons of crude oil, equating to 13.91 million barrels per day (bpd) – fell from 14.19 million bpd in June and 14.87 million bpd in July 2023. The decline in production was influenced by planned overhauls at major refineries, reduced gasoline demand despite summer travel, and the growing popularity of electric vehicles. In contrast, China's crude oil and natural gas production saw moderate growth.

------------------------------------------------------------------------------------------------

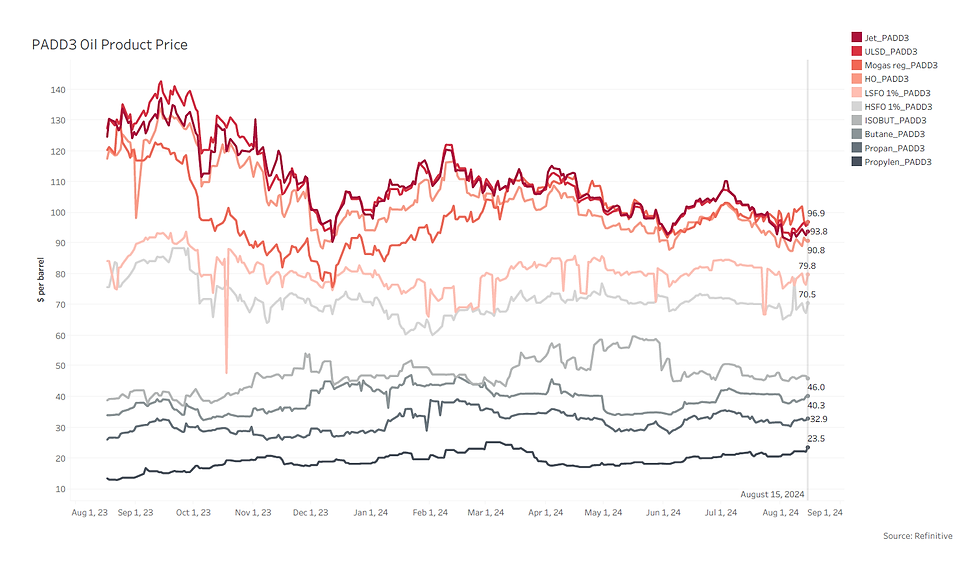

Slowing global jet fuel demand heightens concerns over oil market outlook

Global jet fuel demand is expected to weaken due to slowing consumer spending, which could further dampen oil prices. Despite initial expectations for strong growth as travel rebounded post-pandemic, demand has underperformed, with only a 500,000 barrels-per-day (bpd) increase through July 2024. Global jet fuel demand averaged approximately 7.49 million barrels per day (bpd) from January through July this year, marking an increase of nearly 500,000 bpd compared to the same period last year, according to data from Goldman Sachs. To reach the bank's annual growth forecast of 600,000 bpd, demand will need to accelerate in the coming months. However, this seems unlikely, as Goldman Sachs projects demand growth between August and October to be only around 400,000 bpd. Factors contributing to the slowdown include weaker economic activity in the U.S. and China, improved aircraft fuel efficiency, and changes in consumer travel behavior. The International Energy Agency and the Organization of the Petroleum Exporting Countries have both revised down their oil demand forecasts due to these trends.

------------------------------------------------------------------------------------------------

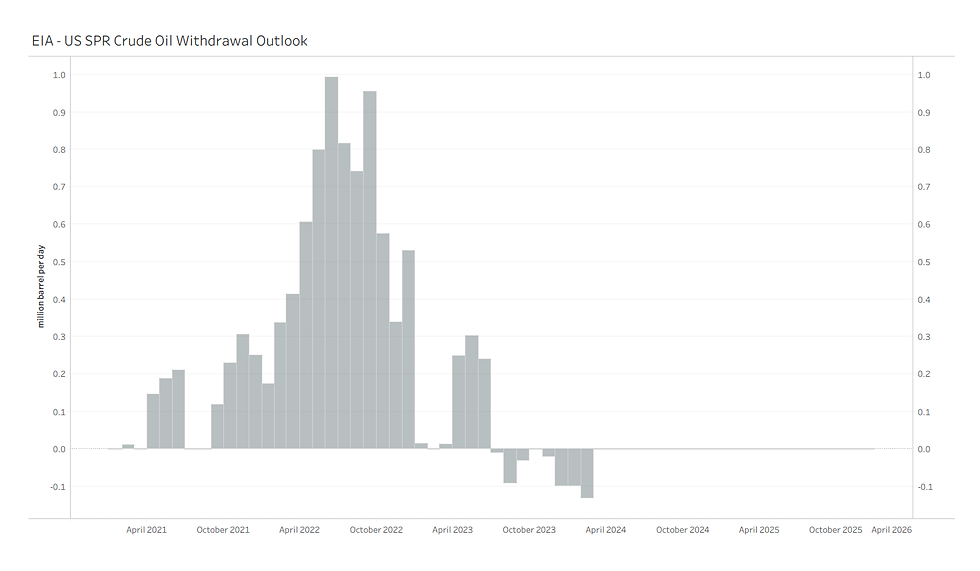

US buys 1.5 million barrels of oil to replenish strategic reserve

The U.S. government has purchased 1.5 million barrels of oil for the Strategic Petroleum Reserve (SPR), with delivery set for January. This move is part of an ongoing effort to gradually replenish the SPR after the sale of 180 million barrels in response to Russia's invasion of Ukraine in 2022.

------------------------------------------------------------------------------------------------

John Fredriksen sells VLGC fleet to BW LPG in $1 billion deal with Andreas Sohmen-Pao

John Fredriksen is selling his VLGC (Very Large Gas Carrier) fleet to Andreas Sohmen-Pao's BW LPG in a deal valued at over $1 billion. The transaction includes 12 VLGCs from Fredriksen's Avance Gas, leaving Avance with four medium-sized gas carriers, a significant stake in BW LPG, and substantial cash reserves for dividends. This acquisition increases BW LPG's fleet from 41 to 53 ships, strengthening its market position. The deal includes a mix of cash, debt novation, and BW LPG shares, with Avance becoming the second-largest shareholder in BW LPG.

------------------------------------------------------------------------------------------------

STAX engineering to provide mobile emissions capture for Shell’s LA terminal

STAX Engineering has signed a five-year agreement with Shell’s subsidiary, Equilon Enterprises, to provide mobile carbon capture services for tankers docking at Shell’s Mormon Island terminal in Los Angeles. Starting in 2025, STAX will help tankers comply with California's new emissions regulations using their land and barge-based technology, which captures emissions without requiring vessel modifications. This deal makes STAX the first emissions control provider for tankers in California. The company aims to expand its operations across North America and beyond, having already treated 98 vessels and significantly reduced pollutants. South Korea’s Hyundai Glovis and Japan’s NYK Line are partnering with the company.

Comments